Direct selling involves selling products through a network of independent contractors. Ponzi fraudsters also exploit the retail model to defraud the general public, disguising themselves as a direct selling enterprise.

Nevertheless, it is essential to acknowledge the negative aspects of this model, as instances of fraudulent activities and Ponzi schemes have caused significant harm to numerous individuals. This article explores the intricate nature of fraudulent practices, the specific demographics they prey upon, and the profound consequences they engender.

The Distinction between Direct Selling-Multi-Level Marketing (MLM), and Ponzi Schemes: A Nuanced Analysis

Direct selling-MLM is a business model that operates through a hierarchical structure of salespeople commonly known as direct sellers. These salespeople generate income by engaging in direct sales, as well as by earning commissions from the sales and purchases made by the individuals they have introduced into the programme.

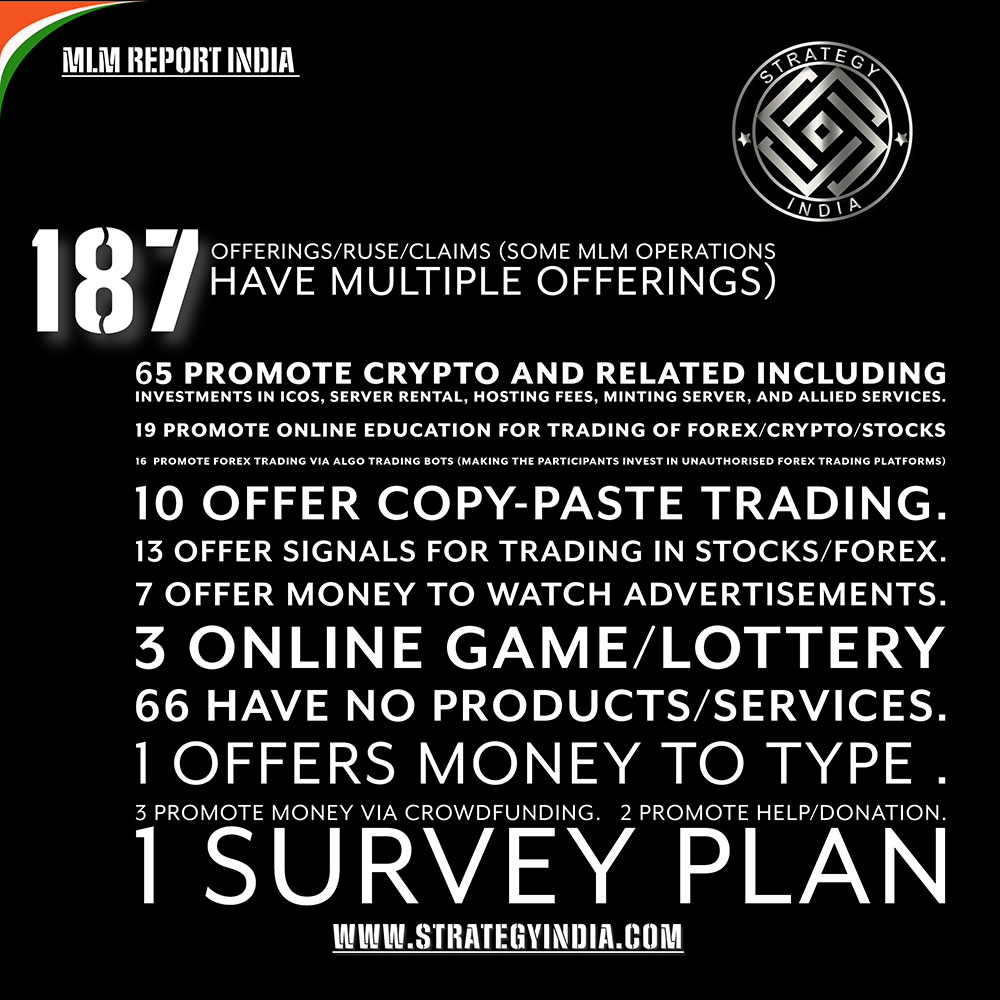

In contrast, Ponzi schemes, which derive their name from the notorious figure Charles Ponzi, offer investors the prospect of substantial returns, wherein profits are primarily generated from the investments made by new participants rather than through legitimate and viable business operations.

The distinction between a bona fide direct selling multi-level marketing (MLM) enterprise and a fraudulent Ponzi scheme is often indistinct. The primary distinction lies in the origin of revenues.

Direct Selling MLMs generate revenue by selling tangible products and services. In contrast, Ponzi schemes depend exclusively on the infusion of new investments, often involving the sale of products lacking substantial value and characterised by extravagant names or even non-existent products.

Targeting Victims: The Art of Deception

The individuals perpetrating Ponzi schemes are adept manipulators who employ their cunning to select and exploit their victims effectively. The potential targets encompass various socioeconomic statuses, age groups, and educational backgrounds. These scams can ensnare not only those who are naive or uninformed but also individuals who possess extensive investment experience, law enforcement professionals, and individuals with a strong understanding of financial matters.

The Optimal Prey

There exist specific demographic groups that are particularly susceptible to becoming victims of multi-level marketing (MLM) Ponzi schemes.

- individuals currently engaged with their financial planner, accountant, broker or investment adviser are considered vulnerable and susceptible to exploitation. These professionals are trusted due to established business relationships.

- Religious or organisational affiliations are frequently exploited by Ponzi schemers as they specifically target individuals who are associated with such groups. The strategy referred to as affinity fraud capitalises on the intrinsic trust existing within closely interconnected communities.

- Individuals frequently targeted as victims are often friends and family members of the original targets and business associates. Fraudsters leverage trust and interpersonal connections to execute their fraudulent activities.

- Individuals who experience the fear of missing out (FOMO) may be susceptible to fraudulent activities in the current landscape of meme stocks, and individuals rapidly accumulate wealth through cryptocurrencies. Individuals enthusiastic about embracing the latest investment trend are susceptible to becoming victims of these fraudulent schemes. And yes, social media influencers are crucial in spiking interest in these schemes.

- Individuals affected by Ponzi scams - Victims often desire to recoup their financial losses, leading them to engage in similar fraudulent activities by seeking new investors and transitioning into the role of perpetrators themselves.

The Harsh Reality: Implications for Victims

Victims of Ponzi schemes face devastating consequences that go beyond financial losses. These implications span various aspects of their lives, including emotional, health, and behavioural issues and the impact on employment, family unity, and the business community.

- The Financial fallout

Victims often suffer severe financial losses, forcing them to sell properties, return to work post-retirement, face bankruptcy, or struggle to obtain credit. They also invest considerable time dealing with the economic harm, adding to their stress and anxiety. - The Emotional turmoil

Ponzi scams inflict deep emotional wounds on their victims. Feelings of shame, guilt, and self-blame are common reactions. Victims often perceive themselves as weak or foolish, reinforcing the trauma caused by the fraud. - The Health and Behavioural impact

The stress and anxiety resulting from these scams can lead to serious health issues, including depression and physical ailments. Some victims even resort to suicide as their losses become unbearable.On the behavioural front, victims often exhibit self-blame, guilt, and shame. They may attempt to hide their victimisation or avoid reporting the fraud to authorities to escape public humiliation. This silence, stemming from shame, inadvertently aids the fraudsters by allowing them to evade punishment and continue their deception.

The Reaction of Victims: A Cycle of Silence

The responses exhibited by individuals who have fallen victim to a Ponzi scheme are multifaceted and diverse. While specific individuals may experience emotions of guilt and shame, others might engage in efforts to conceal their victimhood, refrain from reporting fraudulent activity, or even reject the actuality of their circumstances.

Silence and Denial

Frequently, individuals who have experienced harm opt to withhold their accounts due to apprehension regarding societal disapproval and the potential for public shame. Individuals may engage in the act of denying their victimisation, potentially even to their own consciousness, as a means of coping with the distressing experiences they have endured. The absence of acknowledgement and refusal to acknowledge can exacerbate the social isolation experienced by victims and extend the duration of their distress.

Reluctance to Report

One prevalent response observed among individuals who have fallen victim to fraudulent activities is a notable hesitancy to report the incident to law enforcement agencies formally. The hesitancy observed can be attributed to individuals' apprehension regarding potential public scrutiny, the tendency to assign blame to oneself, and scepticism towards the efficacy of the legal framework. Nevertheless, the failure to report fraudulent behaviour enables the perpetrators to persist in their illicit endeavours without encountering any obstacles.

Self-Blame and Guilt

Numerous individuals tend to attribute responsibility to themselves for succumbing to fraudulent schemes. Individuals may experience feelings of guilt due to their perceived lack of caution or knowledge, which prevents them from avoiding the aforementioned trap. The attribution of blame to oneself can result in the experience of guilt and shame, thereby intensifying one's emotional distress.

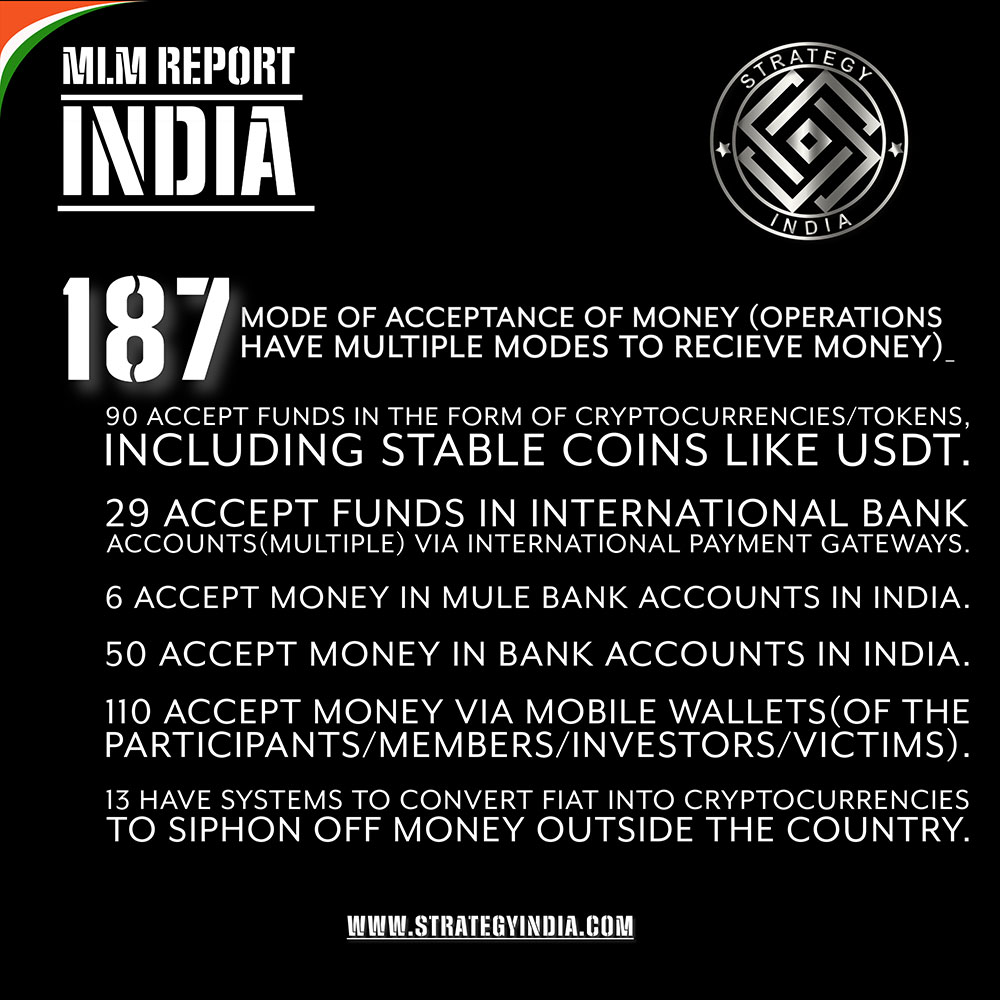

The Unravelling of MLM Ponzi Schemes: A Ticking Time Bomb

MLM Ponzi schemes operate under the radar like a ticking time bomb waiting to explode. They require a constant influx of new investors to sustain the high returns promised to the existing ones. The scheme begins to collapse once the flow of new investments dries up and the payments are stopped. The trigger can be as small as a post on social media by one of the victims or a report by an investigative journalist, and therefore, the fraudsters pay much money to individuals in the position of influence in the government to remove such reports/articles before they go viral.

The Perceived Fallacy of Excessive Returns

Fraudulent individuals entice potential investors by making enticing claims of exceptionally high returns while downplaying associated risks. Early investors are remunerated using funds obtained from subsequent investors, thereby generating a deceptive perception of substantial profits. This phenomenon attracts a more significant number of individuals to engage in investment activities, thereby sustaining the fraudulent scheme.

The Imminent Collapse

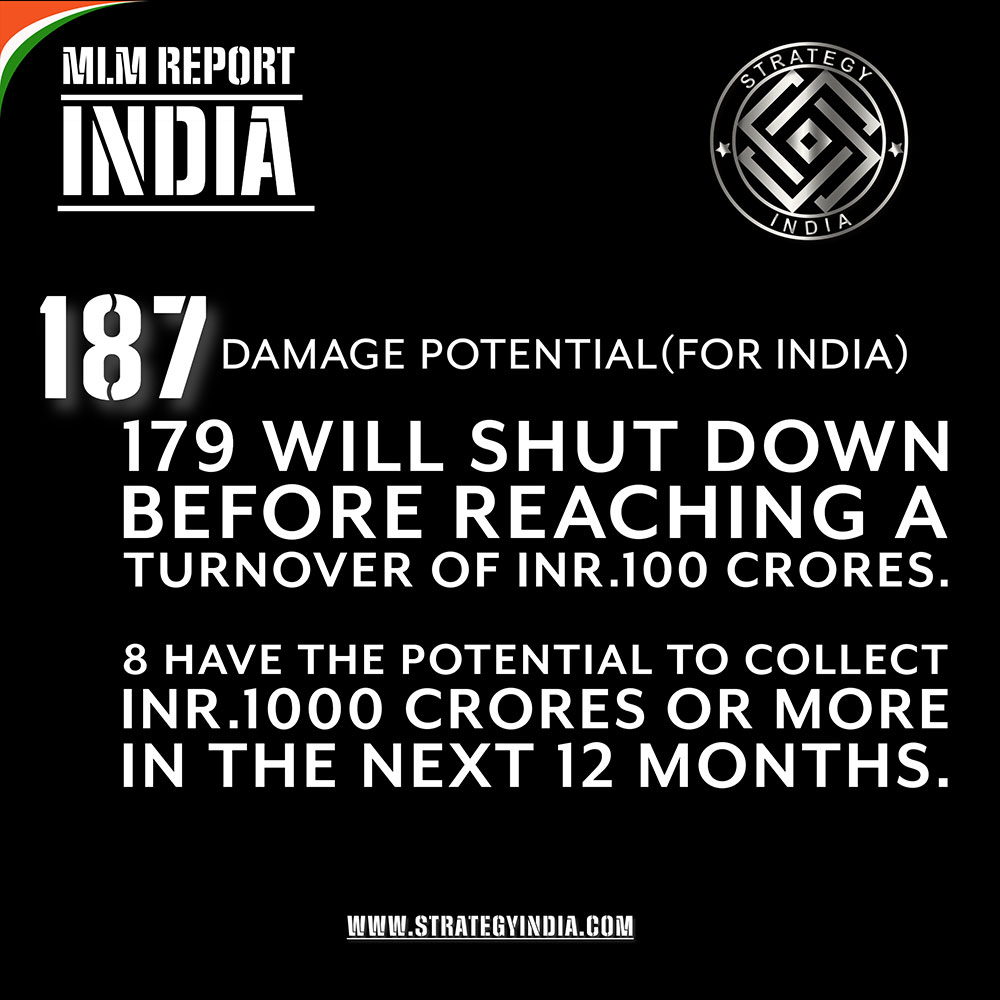

Nevertheless, the perpetuation of this illusion is ultimately unsustainable. Once the influx of new investors becomes depleted, the pyramid scheme experiences a collapse.

Typically, the subsequent investors, constituting the pyramid's foundation, tend to experience the most significant detriment, as they often incur the loss of their entire or majority investment.

The Role of Regulators and Authorities in Ensuring Compliance and Oversight

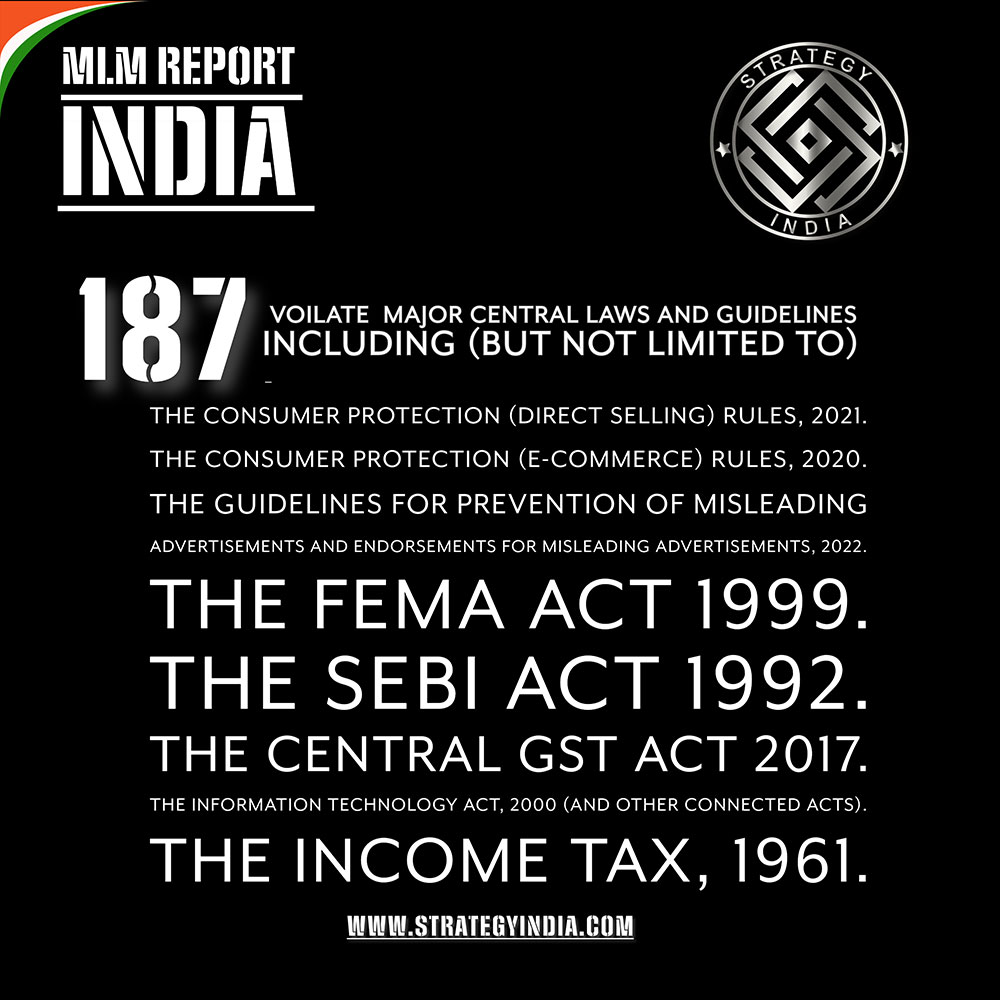

Regulators and authorities are crucial in preventing and prosecuting Ponzi schemes. Though little is being done to prevent enormous scale damage to the fabric of society by Organisations like the Reserve Bank of India(RBI), Securities and Exchange Board of India (SEBI), Securities and Exchange Commission (SEC) and Federal Trade Commission (FTC) in the U.S., and similar bodies in other countries, are responsible for regulating the financial markets and protecting consumers from fraudulent practices.

These regulatory bodies mostly take more reactive measures than preventive ones and undertake enforcement actions, including investigations, litigations, and penalisations.

Investor Education and Awareness

Regulatory bodies also play a pivotal role in educating investors about the potential risks associated with Ponzi schemes and other fraudulent activities. The organisation releases alerts and advisories, offers resources for educating investors, and endeavours to raise awareness regarding indicators of investment fraud.

In conclusion, it can be argued that maintaining a state of awareness and vigilance is the most effective means of defence.

Protecting citizens from Ponzi schemes entails preserving their financial assets and the maintenance of their mental and emotional well-being, thereby fostering trust in governmental institutions.